Insights & News

FourSight: Q2 in the Rear View

THE SKY IS NOT FALLING…

There’s been talk of a slowdown in deal activity, but some market experts are actually reporting an uptick. GF Data reports on private equity transactions valued between $10-250 million. According to their most recent release, 58 deals were completed by the 205 private equity firms that they tracked in Q2 2016, compared to 46 deals in the previous quarter. Valuations averaged 6.8x Trailing Twelve Months Adjusted EBITDA — which is pretty much in line with the market average for the past two years.

On the other hand, PitchBook Data analysts did observe a decline in activity across the board — but the decline was slower in the middle market. (In case you’re wondering: the middle market comprises companies valued between $10 million and $1 billion.)

SO WHAT’S THE DEAL?

For most of 2015 and Q1 2016, Private Equity Groups (PEGs) were paying higher multiples of EBITDA for smaller “add-on acquisitions,” as opposed to platforms.

(To clarify: when a Private Equity Group buys a company, it’s typically either:

- a “platform” company, which means it will be a standalone investment and operate independently, OR

- an “add-on” acquisition, which means it will be folded into or operate as part of an existing platform business.)

Companies in the middle market are often the natural choice for an add-on: in addition to the synergies they bring to a large platform company, they can be easier to integrate and can provide faster access to new geographies and markets.

Q2 data indicates that things have swung back to traditional metrics, with platforms commanding 6.8x EBITDA versus 6.5x for add-ons. One factor potentially driving higher add-on multiples during 2015 could be the willingness of Private Equity Groups to use the borrowing capacity of larger portfolio companies to pay for acquisitions in an unusually accommodating debt market.

Stay tuned to see how lenders are reacting and whether increased caution from a debt financing standpoint will further impact “add-on” valuations.

TODAY, IT’S A SELLER’S MARKET. TOMORROW, WHO KNOWS?

We’ve said it before, and we’ll say it again: it won’t be a seller’s market forever. Experts are expecting to see a number of business owners take action in the remainder of 2016 — and as baby boomers race toward retirement, there could soon be a glut of businesses for sale, which could eventually drive valuations down.

WHAT ARE BUYERS BUYING IN 2016?

Four major business categories — manufacturing, business services, healthcare services and distribution — comprise 80 percent of GF Data deal volume.

A few deals completed by Private Equity Groups in 2016:

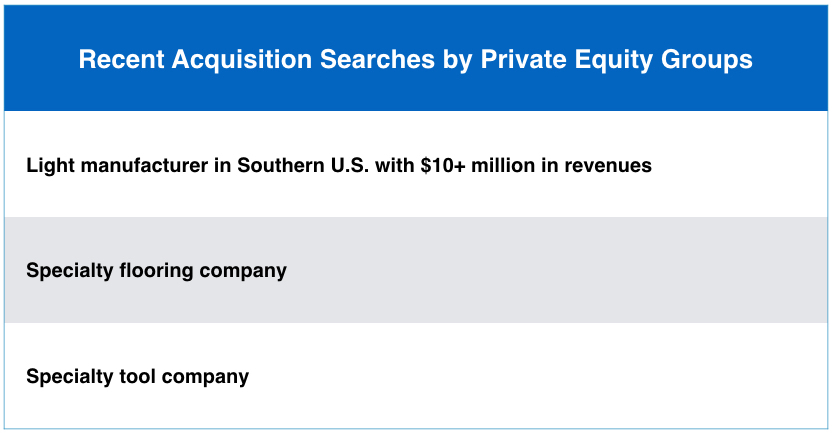

What kinds of companies are buyers looking for? Here are a few recent searches from Private Equity Groups: